tesla tax credit 2021 north carolina

The retail sale use storage and consumption of alternative fuels is exempt from the state retail sales and use tax. Reference North Carolina General Statutes 105-16413.

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek

Once an EV manufacturer has sold 200000 electric vehicles in the US the credit starts phasing out either that quarter or the next.

. Just as electric vehicle EV registrations have grown across the US so has a new tax aimed at EV owners. These states include North Carolina. The second document made further changes.

The following states provide BEV incentives in the form of a refund for your qualifying purchase of a Tesla. EV federal tax credit The. The renewal of an EV tax credit for Tesla provides new opportunities for growth.

North Carolina offers a state emissions testing exemption and car pool lane access to electric and alternative fuel vehicles. Created Jan 25 2015. The list below contains summaries of all North Carolina laws and incentives related to electricity.

Restaurants In Matthews Nc That Deliver. Create an additional 2500 credit for assembled in the US. In order to meet the requirements for.

Tesla and GM are set to regain access to tax credit worth 7000 on 400000 more electric cars in the US with new proposed reform of the federal EV incentive program. Most Tesla cars sold starting on January 1 2022 would be eligible for an 8000 or 10000 credit. In 2021 United States electric vehicle sales grew to over 430000 increasing from 2020.

President Bidens Build Back Better bill would increase the electric car tax credit from 7500 to 12500 for qualifying vehicles however this bill has only passed and not the Senate as of April 2022. Oregon offer a rebate of 2500 for purchase or lease of new or used Tesla cars. A refundable tax credit is not a point of purchase rebate.

2nd 2021 948 am PT. North Carolina offers a state emissions testing exemption and car pool lane access to electric and alternative fuel vehicles. North Carolina solar rebates.

The program which expires in 2022 can lop off about a third of the cost of an average sized solar energy system. Restaurants In Erie County Lawsuit. Place an 80000 price cap on eligible EVs.

As far as I understand it the sales tax rate is determined by the location of the dealership. Listed below are incentives laws and regulations related to alternative fuels and advanced vehicles for North Carolina. Tesla S 7 500 Tax Credit Goes Poof But Buyers May Benefit Wired Tesla Model S 3 X Y In California Now Eligible For Additional 1 500 Tesla Earns Modest Q2 Profit Delivers 5.

Tesla Tax Credit 2021 North Carolina. Right now buyers will get 1875 -- one fourth of the original sum -- back on their 2019 taxes if. Tax credit up to 50 of cost or 2500 for an EV conversion.

This credit includes both the 7500 main credit plus another 500 for Tesla cars with American-made batteries House version or another 2500 Senate. The effective date for this is after December 31 2021. For an average 27000 solar system the homeowner can claim around a 7020 credit when filing their 2021 taxes.

Instead its allocated to each manufacturer. A federal tax credit is available for 30 of the cost of the charger and installation up to a 1000 credit means 3000 spent. In this example if you owe 7500 in taxes you will only need to pay 480 after.

Tax credits for heavy duty electric vehicles with 25000 in credit available in 2017 20000 in 2018 18000 in 2019 and 15000 in 2020. The 7500 federal tax credit doesnt have a set expiration date per se. You can get a tax credit of 25 for any alternative fuel infrastructure project including building an electric charging station.

Louisiana 8000. Create an additional 2500 credit for union-made EV. An average 8 kilowatt kW system would be eligible for a rebate of 3200.

Charging station parts and labor costs also exempt from state sales tax. Tesla is seeing a delay in its lithium supply for next year as a North Carolina mining. 35 tax credit on price of an EV up to 1500 for a BEV and 1000 for a PHEV.

Eleven states now charge owners of EVs including plug-in hybrids and in some cases hybrid electric vehicles some form of an annual tax or fee at registration. Duke Energy has run out of available funds for rebates in the first half 2022. Tesla tax credit 2021 north carolina Sunday February 27 2022 Edit.

There are also rebates available for nonresidential customers worth 030Watt up to 30000 and for nonprofit customers worth 075Watt up to 75000. State Incentives Alternative Fuel Tax Exemption. Duke Energy and Duke Energy Progress DEP are in the fourth year of their five year commitment to 6000 solar rebates for homeowners.

PHEVs exempt from states 03 motor vehicle sales tax. Top content on Tax Tax Credit and Tesla as selected by the EV Driven community. There are a number of powerful financial incentives available to North Carolina residential commercial and nonprofit solar projects in 2022.

You can get 600 per kilowatt kW up to a maximum of 6000. Solar customers can join a waitlist. At least 50 of the qualified vehicles miles must be driven in the state and the credit expires at the end of.

You can also access coordinator and other agency contact information in the points of contact section. The NC Electric Vehicle Tax Debate. Opry Mills Breakfast Restaurants.

Majestic Life Church Service Times. How Much is the Electric Vehicle Tax Credit for a 2021 Tesla. Sales of 2022 of Electric Vehicles continues go grow.

Your Clean Cities coordinator at your local coalition can provide you with information about grants and other opportunities. Are Dental Implants Tax Deductible In Ireland. BEVs exempt from states 65 sales tax.

Based on our projections Tesla is set to reach the 200k mark sometime in early 2018. The credit halves itself every quarter until it reaches 0.

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek

How Much Does Tesla Car Insurance Cost Nerdwallet

Reforming Michigan Vehicle Direct Sales Laws Cato Institute

Ev Start Up Lucid Begins Production Of 169 000 Air Dream Edition

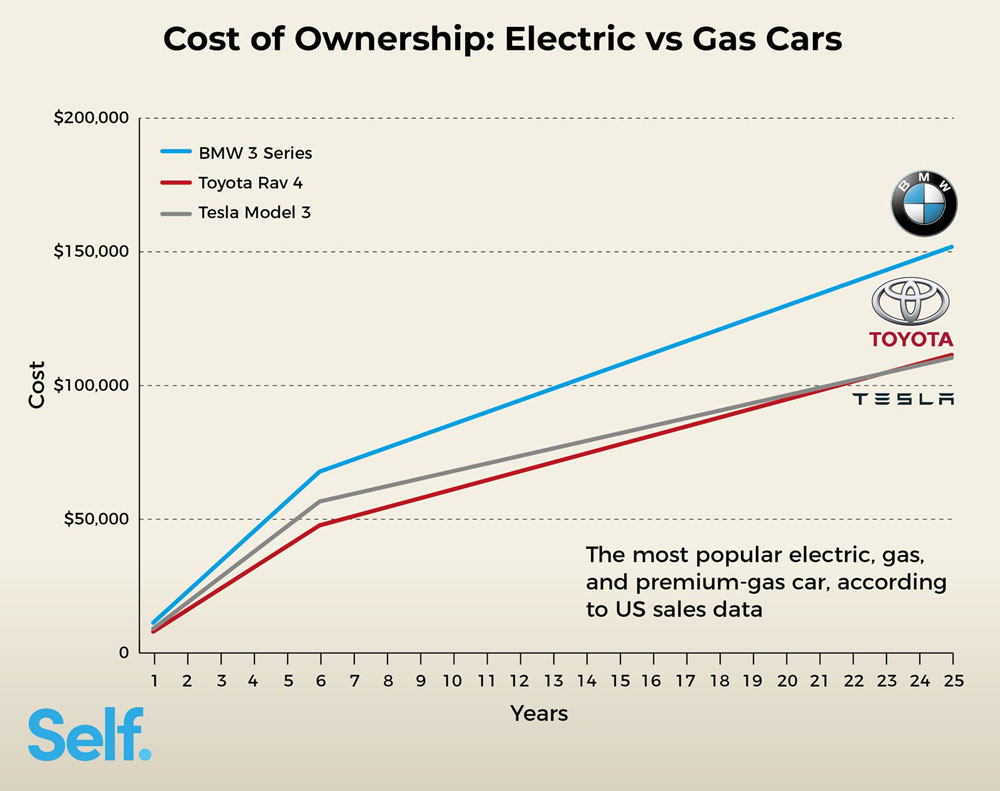

Electric Cars Vs Gas Cars Cost In Each State Self Financial

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek

Federal Register The Safer Affordable Fuel Efficient Safe Vehicles Rule For Model Years 2021 2026 Passenger Cars And Light Trucks

Bmw Over 6 000 Lbs That Qualify For Tax Deduction X5 X6 X7 Tax Credit

North American Supply Chains For Lithium New Age Metals Inc

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek

25 Factors That Will Affect Ev Adoption Part 1 Cleantechnica